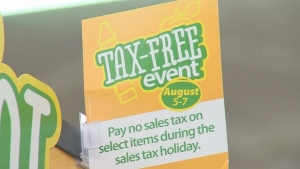

Texans that are shopping for back to school season have a chance to take advantage of big savings this weekend. The tax free holiday has officially begun and runs through Sunday August 7th.

Texans that are shopping for back to school season have a chance to take advantage of big savings this weekend. The tax free holiday has officially begun and runs through Sunday August 7th.

According to the National Retail Federation the average shopper will spend over $673 during the tax free holiday, that’s a $44 jump from last years forecasted spending average. The NRF projections show that teenagers will likely spend $33 of their own money when it comes to back to school shopping while pre-teens are estimated to spend $20.

The Texas Comptroller of Public Accounts recently published “The Fine Print” of tax free information for consumers to help free up confusion and understand how the sales tax holiday works. The sales tax exemption applies to specific items that are priced at under $100 including many back to school items like backpacks, pencils, paper, and other items.

When it comes to clothing, according to the Texas Comptroller, the sales tax only applies to items under $100 and not designed for athletic or protective purposes. For example, athletic students would not be able to see a tax free savings on items like football cleats. Items like t-shirts, shorts, even tennis shoes could be listed as tax free they are common clothing items that are not made specific athletic activity.

There are similar rules when it comes to backpacks. For traditional backpacks, messenger bags, even backpacks with wheels are eligible for tax free exemptions as long as they are priced below $100. But the Texas Comptroller outlines that items defined as luggage are not eligible for the tax exemption.

School supplies like pens, paper, note pads, glue and other elementary or secondary school supplies under $100 are also eligible for the tax free exemption. However, if a consumer is buying these items in bulk under a business account unless they have an exemption the purchaser would not be eligible to save on the sales tax of the items.

Some stores like Wal-Mart on Greenbriar Road in Wichita Falls are helping their shoppers during the back to school holiday by providing a list of items at the front of their stores to help shoppers better understand what is and is not listed as tax free.

If you’re looking for more information on the tax free holiday you can click HERE for a link to the Texas Comptroller of Public Accounts “The Fine Print” of tax free information for consumers.

– Newschannel 6